There is no “fair” real estate appreciation, and a nominal increase slightly below inflation is not screwing anyone over. Homeowners will be fine, this is the one thing that is for certain in all of this

mostly inactive, lemmy.ca is now too tainted with trolls from big instances we’re not willing to defederate

There is no “fair” real estate appreciation, and a nominal increase slightly below inflation is not screwing anyone over. Homeowners will be fine, this is the one thing that is for certain in all of this

point is subsidizing first time buyers allows for affordability without lowering prices. It in fact, increases prices of starter homes because of the subsidy, but only while the subsidy lasts.

Exactly, we mostly agree. Demand subsidy is yet another way to enable price increases. It doesn’t really make housing more affordable. So that’s why agree with you that subsidies cost money without solving the problem.

trailing 5 years home appreciation being 15% (3%/year)

Now this is good, despite all the hot feelings regarding affordability right now, it is true that in the last two years several markets have observed real estate performing below inflation, which is good. We just need this to last 20 years to go back to a healthier market. In the mean time, subsidies can help the families that cannot wait 20 years to afford housing, so I’m not against demand subsidy - I’m just against the notion that subsidies are good for affordability, they’re not.

Prices have to decrease, period. We can put some makeup on this and trick homeowners into satisfaction by having some nominal increase without accounting for inflation… but just being real (pun intended), prices have to decrease. Price net of inflation is the number that matters, and it has to go down. Real returns on housing has to be negative, sustained over decades.

How so? Encouraging people to vaccinate their kids and making the vaccine free is still an “opt in” system. What I mean with an opt out system is that it would demand effort and a processual review to not vaccinate (at some level, even if at the community level), like filing for being excused of immunization and having that file as part of the immunization record.

Makes sense. I’ll be rooting for that vision. Time for a new Vancouver Special :-)

Yes. Just like they already kind of are in a bunch of ways. At the very least they should be opt-out instead of opt-in, with immunization campaigns deployed in the spirit of increasingly making opt-out more exceptional

I guess the difference in outlook is that I don’t really see a realistic increase in purchasing power that won’t also get immediately scooped up by a similar increase in price. All the measures you mentioned also affect prices too. The reason I say “purchasing power” explicitly is to not be misleading in that I’m referring to a hypothetical salary keeping up with inflation - something that also really isn’t the case for a lot of people. Someone whose salary is stagnant will also not see the affordability increase in the scenario I’m describing.

Regardless of how smart Carney is, they couldn’t tank the housing market even if they tried. I don’t know why people keep mentioning this as if it was even a possibility. This is the same as people who think someone can just happen to work out too much and end up looking like a monstrous bodybuilder. This is not a thing that is achieved easily enough to consider.

All of these actions will help improve housing affordability and make homeownership more accessible, but not all of them will lower prices, some of them cause price inflation.

To be honest I don’t really get what’s the scenario you’re envisioning here. Making homeownership more accessible is lowering prices relative to purchasing power. This is what lowering prices means, and this is what making it affordable means. You can’t say the intent is to make it affordable while not decreasing prices, these are at odds.

One trick here is using inflation to alter the context of “increase” and “decrease” means. Prices have to decrease in real value (net of inflation), slowly and steadily. In order to keep homeowners in line in their illusion of preserved wealth, prices have to increasing nominally (not counting inflation). So the formula is this: make sure that housing prices climb steadily below inflation for a very, very long time.

your opinion is that the government should just force marginalized folks to do what we think is the right thing regardless of their feelings or experiences?

No

you could literally just google Canada First Nations vaccine hesitancy and learn a whole boatload

Indeed, TIL

This was a pretty interesting read: https://afn.ca/wp-content/uploads/2021/10/Dr.-Valerie-Gideon-Presentation_EN.pdf

That’s not really a tricky balance, there is a clear right direction to pick

I am curious, though. Did First Nation consultation result in any voiced resistance against vaccination?

Why even do this?

Beyond funding the military Industrial complex, there is no reason for this.

What do you mean? There’s no need for more reasons.

Republicans will never lose vote for increasing military funding. Trump family gets gifts and favours, doles out some taxpayer money in a way that their languishing and impoverished voter base approves. It’s the art of the deal.

We’re in for AT LEAST three more contiguous years and a half of this madness. Stalling every bit of the way can make a big difference.

Probably, but I don’t know enough about economics to check.

It is, because the increase is below inflation. Judging by other responses it’s clear that others don’t know much economics either, looks like your intuition already puts you above average.

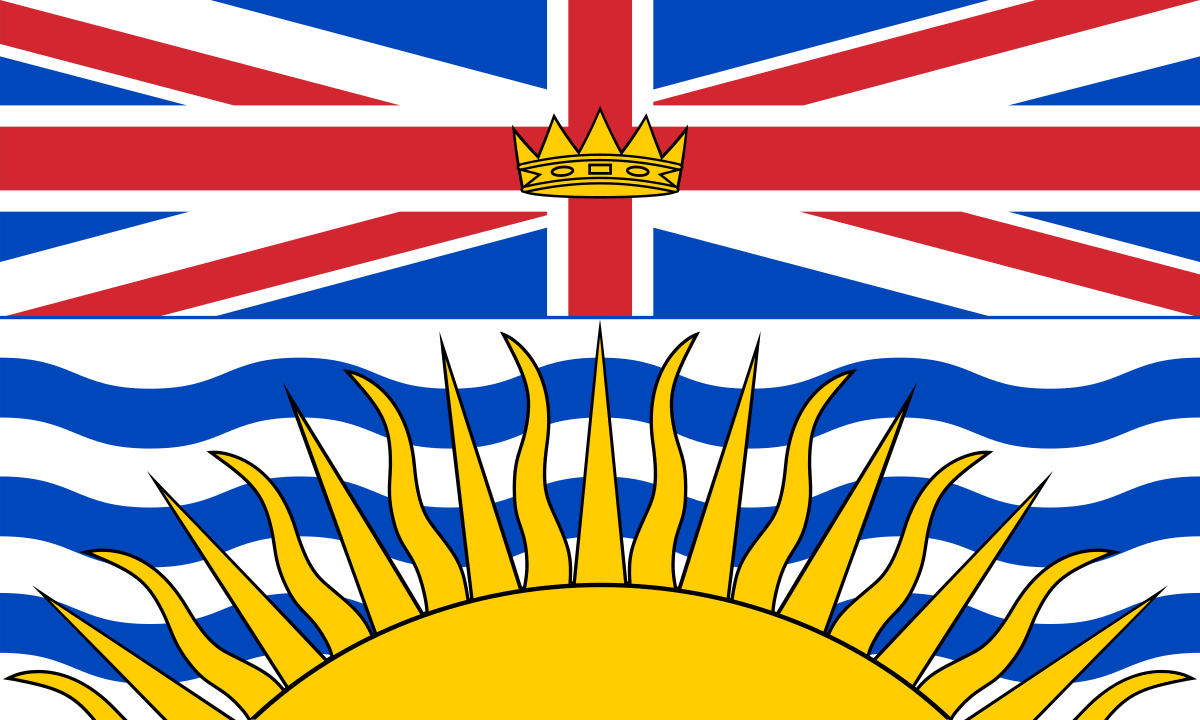

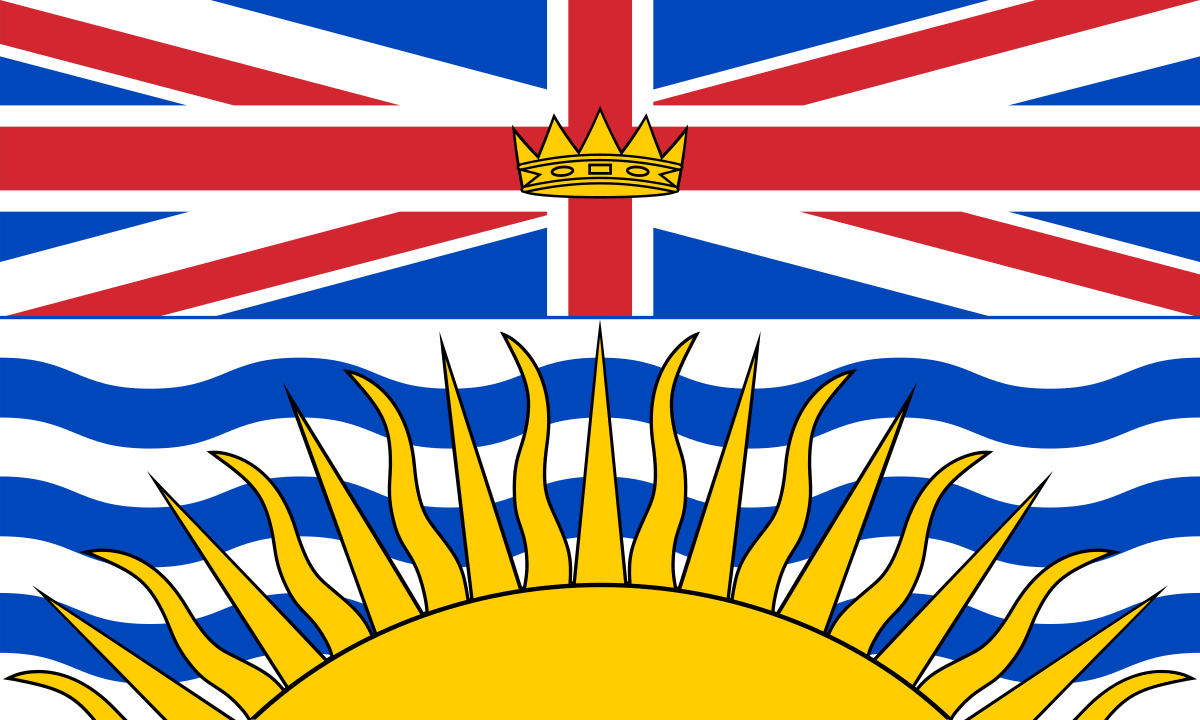

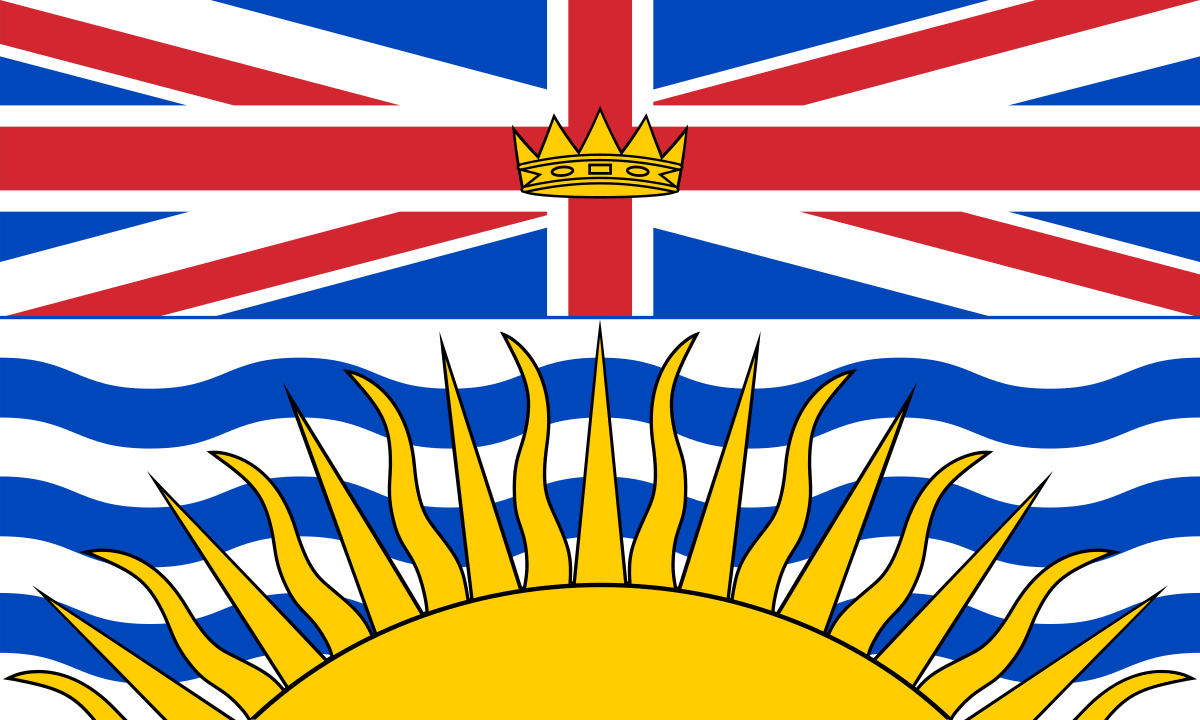

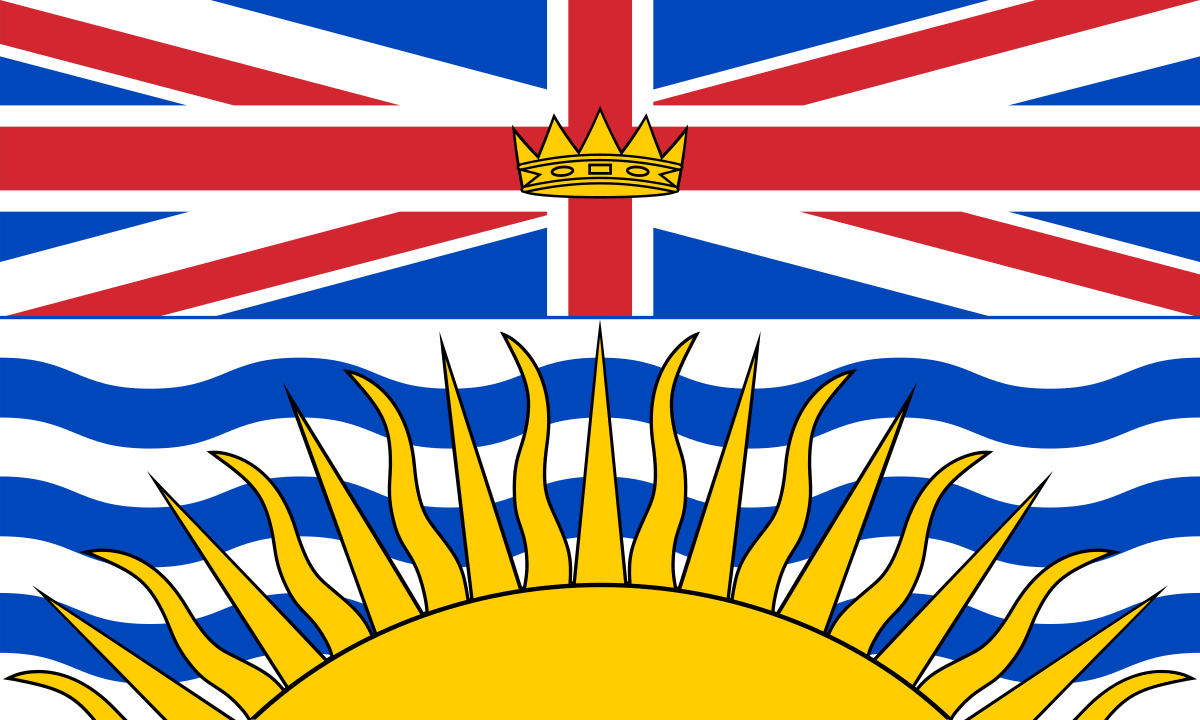

Hint: I’m talking about a provincial election instead of a federal election

You mean red = Liberals and blue = CPC/Bloc? How about orange provinces?

And that’s why [conservatives govts] build and [progressive govts] don’t.

It really isn’t, but nice try.

Isn’t this social credit thing mostly a hoax? They said they would do it but I’ve never met a Chinese person that confirmed they had this up and running

Edit: yeah mostly not a thing, Wiki got receipts https://en.m.wikipedia.org/wiki/Social_Credit_System

Interesting, today I learned.

Oh and that’s one more reason why BC is awesome, it’s the least Christian region!

what does this even men lol learning a new insult slang

deleted by creator

Not necessarily the case here but the word “literally” can be used figuratively so what’s the point of your comment anyway?

But that bureaucracy is what I mean with friction that defines what opting out means. Being invited to immunization and having ease to refuse is still opt in to me.

Maybe I am just unaware but what I understood from what goes into the record is that someone saying “no thanks, vaccines are a lie” is indistinguishable from “the healthcare system wronged my community so I don’t feel safe with this”. If those cases are indeed already distinguishable and I’m just mistaken, then I’ll be gladly corrected because it means that we are already equipped to to make vaccination mandatory, because all we need is to have the due process to accommodate the concerns of the second group.